[ad_1]

The statement of the Rent 2022/23 it has given the starting signal on April 11 —and until June 30— and from that moment you can present it. The problem comes when laziness or even ignorance takes over everyone and you begin to lengthen this process.

The reality is that the sooner you get rid of this procedure, the less chance there is that you will forget it and the 2022/23 Income will no longer be part of your daily thoughts.

That is why in this article we want to give special prominence to those Applications that are born with the aim of helping you in that arduous task. As you already know, technology is there to serve you and bureaucracy is a very special field in which applications are necessary more than ever.

If the Income statement becomes a ball, don’t worry, the following 7 applications are going to save your life when it comes to doing it and they are really easy to use.

Tax Down

The objective is that, in addition to TaxDown being in charge of preparing and presenting your Income Statement, it can help you maximize your savings through the own tool that they have that allows them to analyze based on the data of each taxpayer. what deductions can be applied to try to generate savings for the taxpayer in this process.

Remark that TaxDown is an official collaborating company of the Tax Agencyso you can legally submit the tax return on behalf of your clients through the online tools that the Tax Agency makes available to everyone.

Finally, it has more than 70 professionals who will be able to guide you so that your declaration does not have a single error.

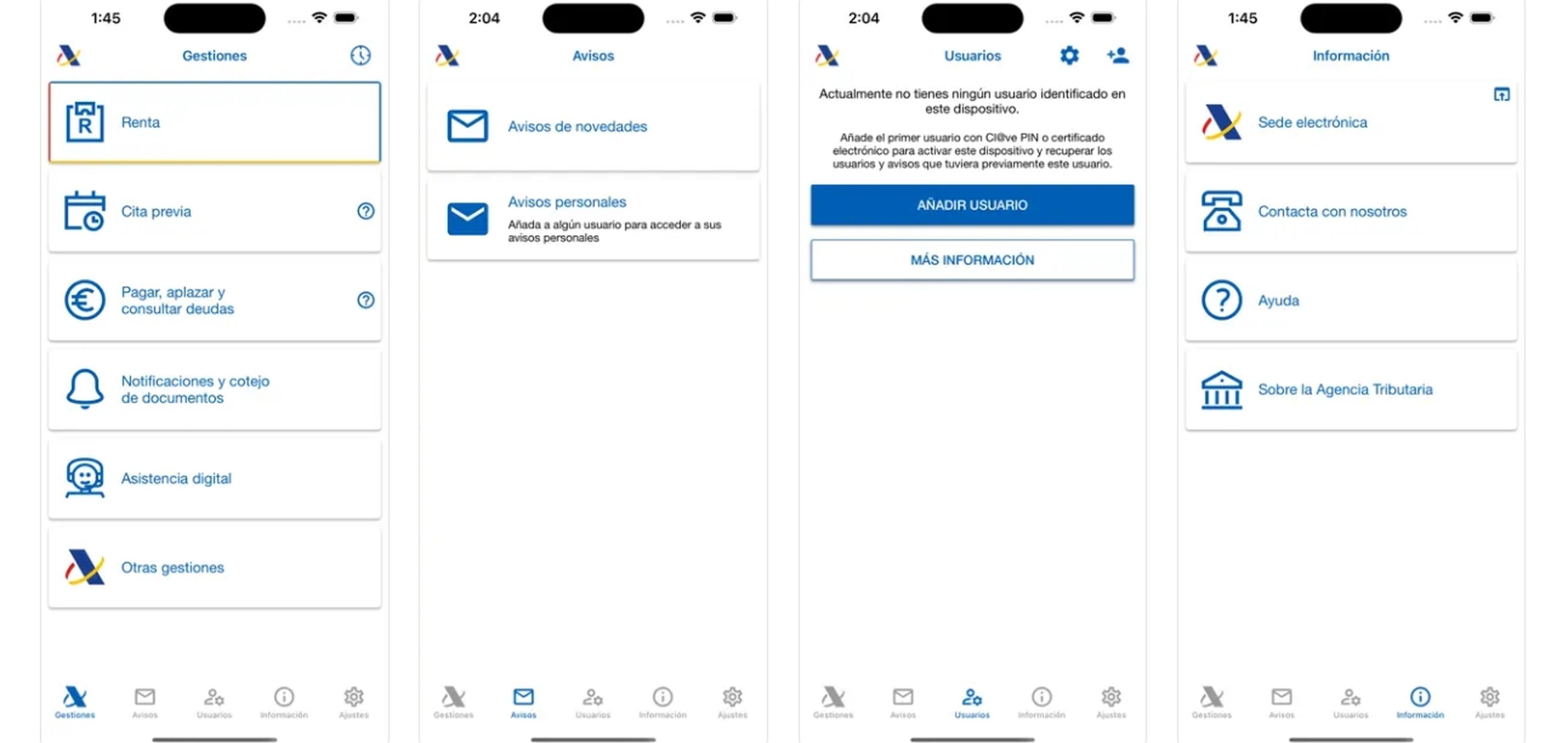

AEAT app

The Tax agency makes available to citizens an app to mobile and tablet that offers the possibility of carrying out procedures with or without user identification in a simple way. With this application you can present your declaration from your phone completely free of charge.

To access its services you will have to click on the ‘Renta 2022’ option on the main menu. Next, it is necessary that you identify yourself with your personal data to be able to log in.

After doing this, you will have to scroll to the option ‘Processing of draft/declaration’, as if it were the same websitewhere you can start making your Income Statement in a matter of minutes.

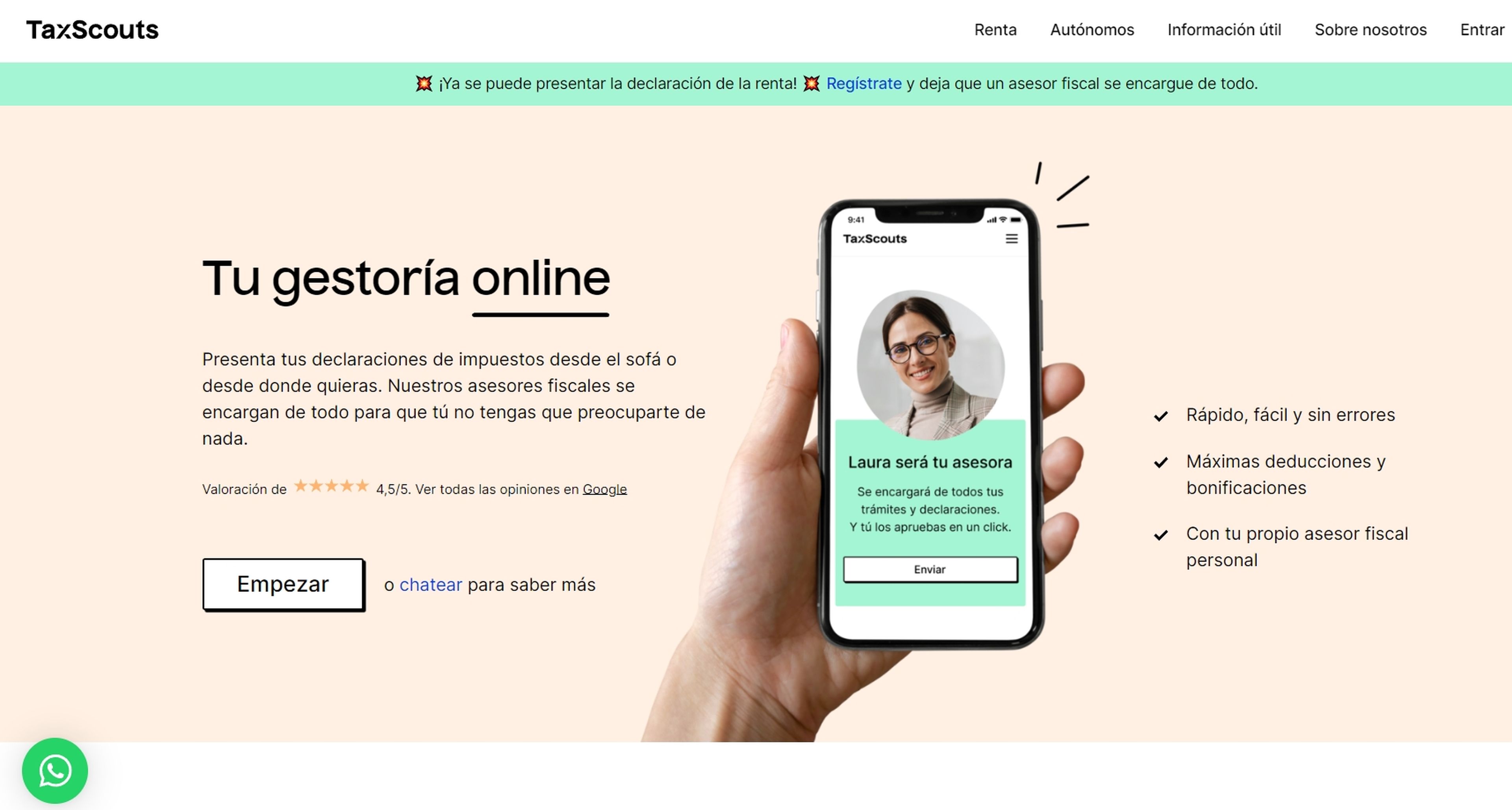

TaxScouts

This website offers a Quite effective advisory and paperwork service. Their goal is to save you headaches and bureaucracy and do everything for you. In this sense, it should be noted that it is a paid service, where you can go to the Rental Pack, which costs €69.90, and the Self-Employed Pack, which costs €39.90.

Regarding services, like the rest, they present self-employed registrations in the Tax and Social Security Agency, quarterly and annual statements of VATwithholdings and personal income tax, income statement and online billing and accounting program.

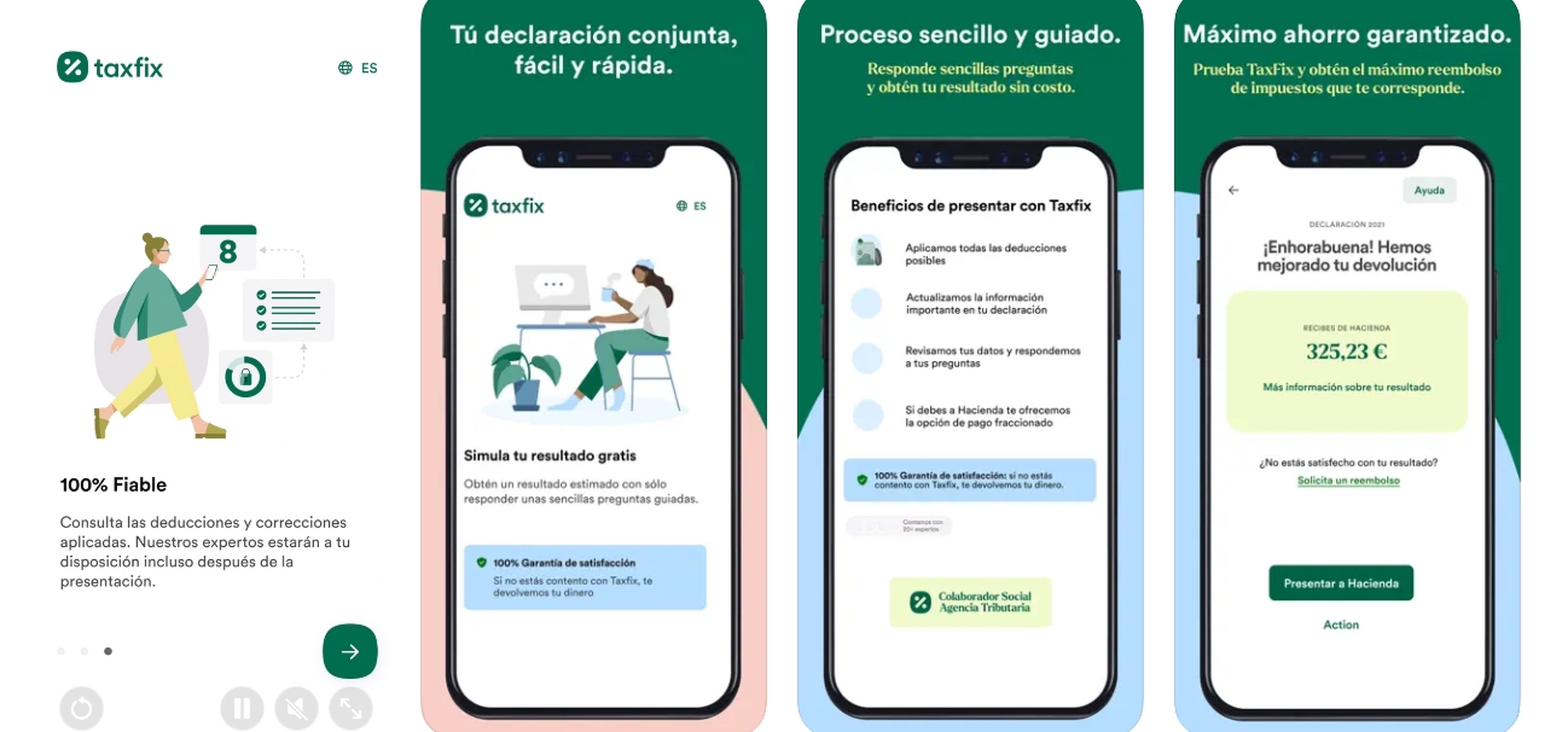

tax fix

Taxfix focuses on helping anyone file an error-free Income Tax return. They analyze your situation in detail to find all applicable deductions to benefit you as much as possible. Mention that They also collaborate with the Tax Agency, so that they can present your declaration automatically.

Taxfix works in a few simple but effective steps:

- Register with your email and they will connect with the Tax Agency to securely access your data.

- Answer a series of questions so they can obtain additional information and offer a fully personalized service.

- Make the payment.

- You will receive your eraser in 1-2 days.

- Once you approve it, they submit your statement to the Tax Agency.

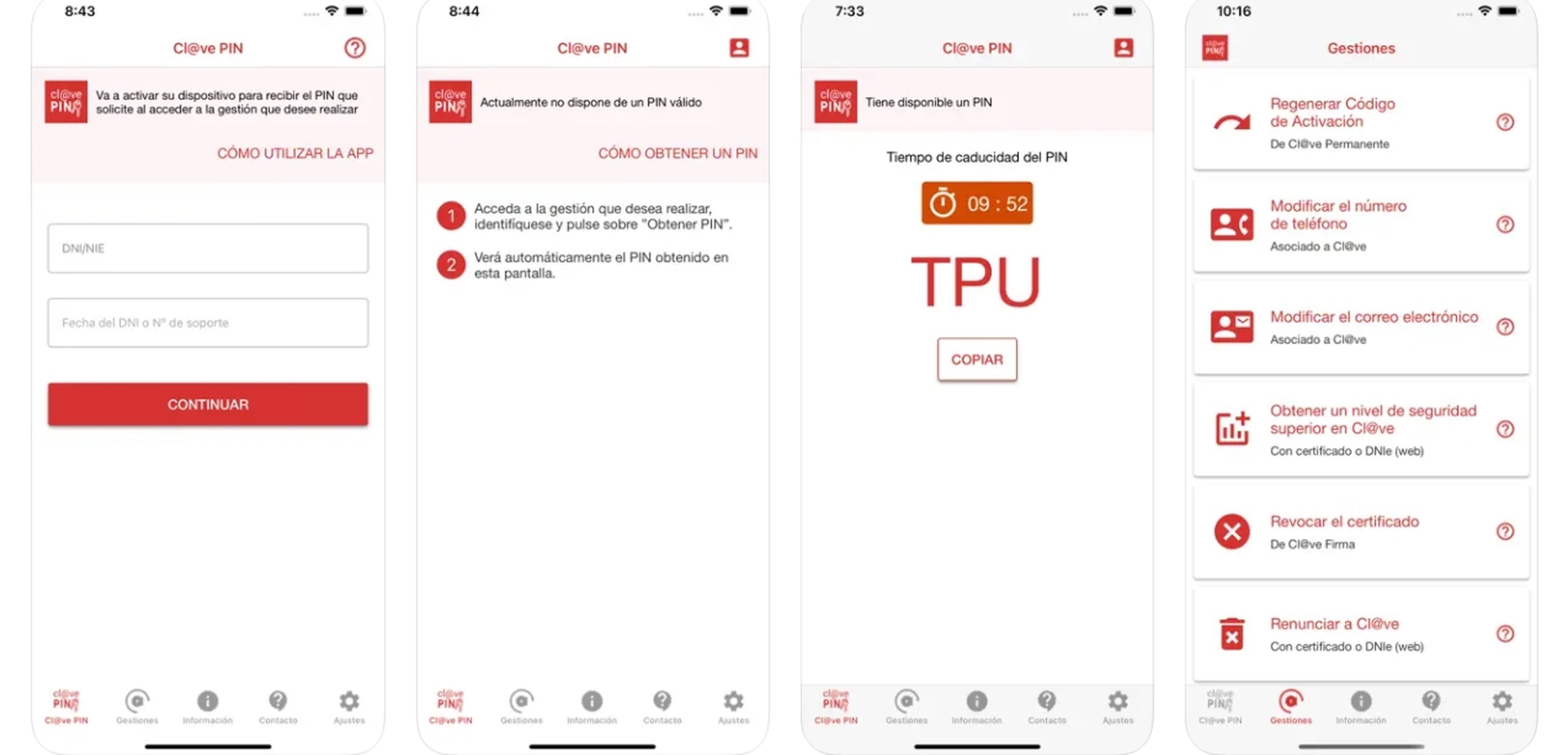

Cl@ve PIN

One of the great basics if what you want is to present the Income statement is this application. Of course, it is also seconded by the Tax Agency since What will help you is to obtain the necessary PIN to carry out tax procedures, such as the declaration itself.

It is not only useful for this procedure —although it is not little—, since you can also take advantage of this PIN to consult any type of personal document such as your work life or other procedures. It is important to add that to use it you must be registered in the Cl@ve system.

okticket

This application is key for many since you are going to be able to record all your work expenses and invoiceswhich will be very helpful when filing your Income Tax return (and when paying VAT), especially if you are self-employed.

there is also approved by the Tax Agency so there will be no problem to present the declaration. In addition, they include a physical ticket digitization function so you never lose them.

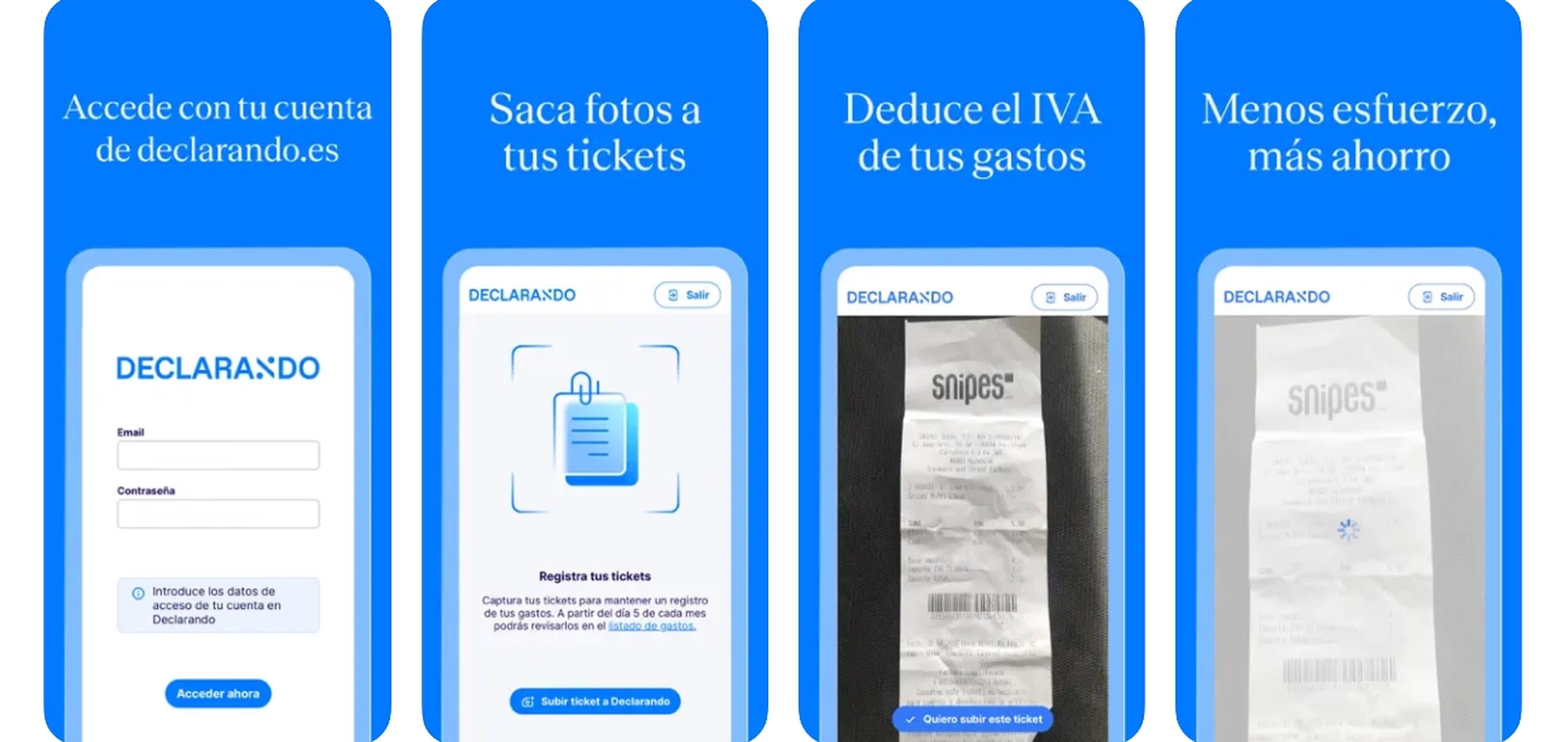

Stating

Declarando is an online tax consultancy, but automated, that It also has experts behind. In short, it is not a simple online agency, it is rather a tool in which you can generate your invoices and record your expenses, as well as present your taxes quite quickly.

Another of the great functions that has already been mentioned with respect to another apps is that with the mobile You can go taking photos of the different tickets and, in this way, the VAT is deducted from the expenses. It also has different plans: the Basic, for 70 euros per month; the Advanced, for 100 euros and the Premium, for 250 euros.

With the use of these applications, in addition to helping you make the Income statement 2022/2023 make it easier, you will be able to discover things that perhaps you were not deducting and that can make the return greater or that you have to pay much less.

[ad_2]